Buffett and his partner Charlie Mangar have always invested in a business where he saw “Competitive Advantage” i.e. competitive lead. In the real estate market, according to him, there is no such edge because this sector is already quite compatible and efficient. In addition, Berkshire Hathaway is a C-Corporation, on which a double tax is levied on real estate or reit income-first at the company level and then at the shareholder level. This ends tax efficiency, which is considered to be the biggest feature of reits.

Capital Gains discount: If you have kept the Reit Units more than 1 year, then only 10% tax is levied on profits above ₹ 1 lakh. Keeping for less time is 15% tax.

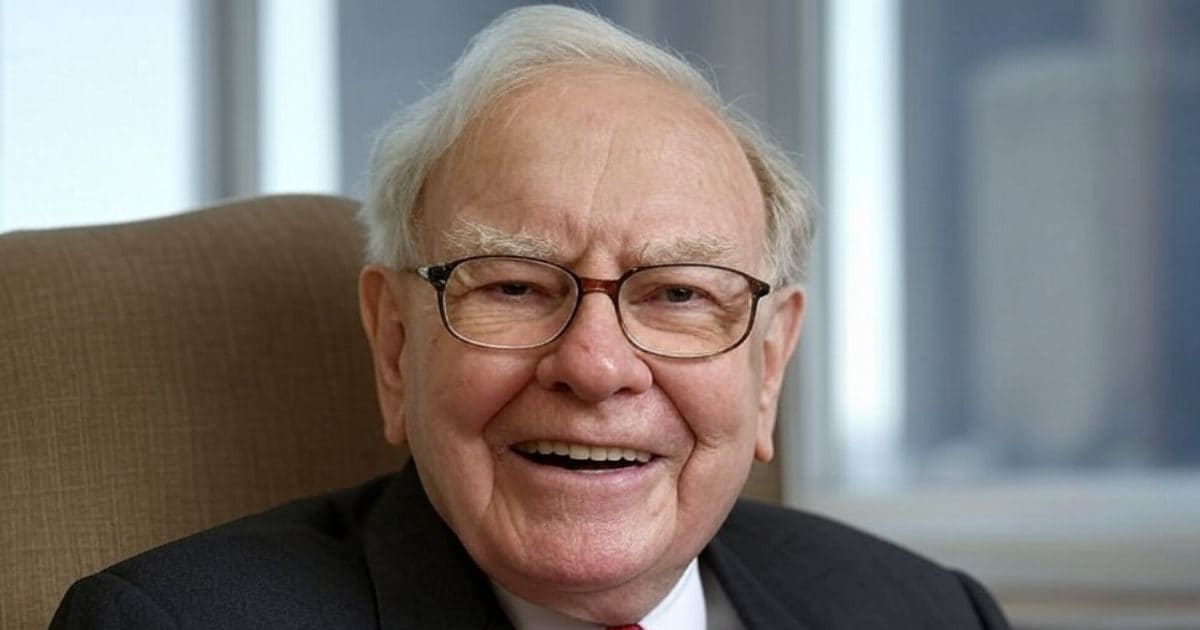

The ‘useless’ for buffett, is ‘beneficial’ for you

Reits for big institutional investors like buffett may be unattractive due to insufficient returns and tax problems, but for an Indian retail investor, they present a combination of low risk, good income, and better liquidity. Reit units can be purchased and sold on the stock exchange like a normal share. Also, GST does not have any direct impact on income and TDS also applies to a limited level.